West Portal’s 9-Story Shock: How Scott Wiener’s Housing Laws Reshape Neighborhoods

The Empire Theater Is Gone—And Sacramento’s Housing Laws Are Coming for West Portal

• • • • • • March 2026 • • • • • •

The 85 West Portal housing project is being built entirely under legislation authored by State Senator Scott Wiener

None of this project utilizes Mayor Lurie’s family housing plan.

The proposed 85 West Portal housing plan envisions a nine-story building with 64 residential rental units, including one, two, and three-bedroom apartments. The design prioritizes larger family-sized units, incorporates ground-floor retail space, and achieves a 100% density bonus. Of the 64 units, 10 will be deed-restricted for affordable housing, with five for very low-income households and five for moderate-income households.

N0 to

85 West Portal!

Only a community can stop this towering development.

Please share this petition widely with your contacts.

Construction will likely begin in early 2027 and will take approximately 18 to 24 months to complete. Further information will be shared as the timeline develops.

Sacramento Overrides San Francisco Neighborhoods

Soon, these larger eight- to nine-story residential buildings will begin to proliferate on both sides of West Portal Avenue, Ocean Avenue, Taraval Avenue, and other corridors. Many small businesses will have to relocate, and many will not survive.

When you see ugly, cheap, overbuilt, small-unit housing, think of Scott Wiener. Over time, he has learned to be a fundraiser who kowtows to contributing developers, the wealthy, and Yes In My Back Yard (YIMBY) advocates—formerly known as SFBARF. His legislation suits his donors’ best interests, but does it suit the public he supposedly represents?

Scott Wiener is running for California’s 11th Congressional District seat in the U.S. House of Representatives. He wants to become the next Nancy Pelosi. Congressional District 11 includes almost all of San Francisco. Due to the deliberate destruction brought about by his housing and commercial-business legislation, neighbors must consider whether he deserves their vote.

If you live in single-family residential housing (RH-1, RH-2, or RH-3) or residential housing detached (RH-1-D), why would you vote for Scott Wiener? If you own a small business inside or outside a Neighborhood Commercial District (NCD), why would you vote for Scott Wiener?

Despite claims of addressing housing needs, most units would be luxury apartments renting for over $4,000 per month. Merchants support reasonable housing but urge a scaled-down project that preserves a 500-seat community theater to restore foot traffic and economic vitality.”

From Local Control to State Mandate

Wiener’s California Senate Bill 79 (SB 79)—officially known as the Abundant and Affordable Homes Near Transit Act—is a major housing law signed by Governor Gavin Newsom on October 10, 2025. Authored by Senator Scott Wiener, it mandates the upzoning of land near high-quality public transit to increase housing density and affordability in California’s urban areas.

If you live within one-half mile of a transit stop, massive residential towers may be built throughout your neighborhood under SB 79. Why would you vote for Scott Wiener?

Wiener has spent the last eight years creating laws that will transform San Francisco’s residential neighborhoods and commercial districts. He is strongly opposed to existing single-family zoning protections, and the author argues he would represent homeowners’ interests poorly in Congress.

Suburban Lifestyle Dream

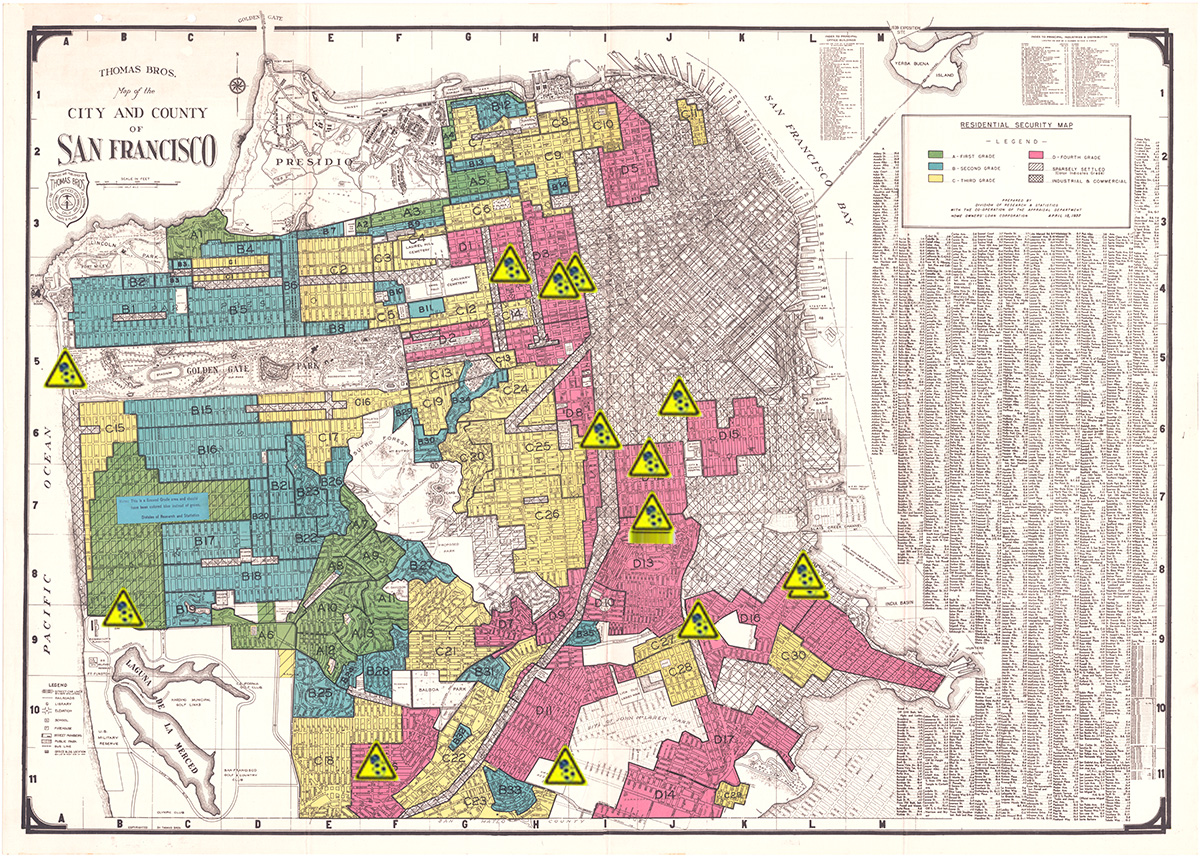

Wiener has described efforts to protect single-family zoning as “dog whistles promoting racial segregation.” If you believe owning your home does not make you a racist, you might not want to vote for Scott Wiener.

D&M Development, the developer of 85 West Portal Avenue, is relying on California state housing laws to build the nine-story residential project at the former Empire Theater site. The project leverages several state laws to bypass local zoning, including:

- AB 2011 – streamlined approval on commercial land

- SB 330 – allows density increases

- State Density Bonus Law (AB 1287) – allows increased height

Assembly Bill 2011 (AB 2011)

AB 2011 refers to commercial land and is the central law used for the 85 West Portal Avenue project, SB 330 allows for double density, and the State Density Bonus AB 1287 allows for increased height.

It allows ministerial, by-right approval of housing on commercially zoned land, requiring a streamlined 90-day over-the-counter review process.

In planning jargon, “by right” means development projects that comply with existing zoning, building codes, and land-use regulations may proceed directly to permitting without discretionary public hearings or special approvals.

By using this law, the project can skip discretionary local reviews and the typical California Environmental Quality Act (CEQA) process.

Merchants Warn of Economic Fallout

Deidre Von Rock, president of the West Portal Merchants Association, has gathered more than 1,300 signatures as of early March 2026 on a Change.org petition opposing the proposed nine-story, 64-unit development at 85 West Portal Avenue.

She argues the project is “grossly oversized” for the neighborhood. Developers may be polite, but they are not required to respond to community objections under AB 2011. Thanks, Scott.

“The out-of-town owners of West Portal’s historic Empire Theater are prioritizing profit over the neighborhood by proposing a nine-story, 64-unit development that far exceeds the corridor’s typical three-story scale. The project would bring at least two years of construction, threatening small businesses already struggling after the theater’s closure. Despite claims of addressing housing needs, most units would be luxury apartments renting for over $4,000 per month. Merchants support reasonable housing but urge a scaled-down project that preserves a 500-seat community theater to restore foot traffic and economic vitality. We call on city leaders to pursue a balanced solution that protects West Portal’s character and businesses.” —Diedre Von Rock

According to the February Daily Standard, District 7 Supervisor Myrna Melgar said she will work with the Planning Department and community members to encourage the developers to choose a building design that “complements the existing charm and vibrancy of the neighborhood.”

However, critics argue that local officials have limited authority to alter the project under current state housing laws.

Margarida MacCormick, a West Portal resident, said:

“I understand that there are plans to tear down the Empire Theater and replace it with a nine-story apartment building. For the record, I am OK if they replace the theater with an apartment building; however, in my opinion, the proposed nine-story structure is far too high and out of scale with the rest of West Portal Avenue and the surrounding neighborhood. The tallest building on West Portal Avenue is the apartment building at 15th Avenue and West Portal Avenue, which is about five stories high and fits the scale of the neighborhood. I am also very concerned about the underground parking plan that calls for an entrance off Vicente Street, which is a short street that already has traffic problems. An apartment building at the Empire Theater site is fine, but it should probably be about half the size of what they are planning.”

Not all West Portalites are against the project. Dominic Galletti, who works at Mozzarella Di Bufala (69 West Portal Avenue), said:

“While the opportunity for a nine-story apartment building is definitely a shock—especially for us—we welcome it because it could bring more business and more people to the West Portal community.”

Small businesses should be concerned about predatory developers making large financial offers to small-business property owners, which could force businesses to relocate if new development occurs.

The 85 West Portal project relies heavily on state housing laws authored by State Senator Scott Wiener, The 85 West Portal developer is relying on his state law. “This housing legislation allows the developer to bypass local review by including sub-market rate apartments in the project. The law was designed to accelerate housing construction that is often slowed, if not outright halted, by “NIMBY activists.”

Weiner refers to homeowners with the derogatory term “NIMBY” (Not In My Back Yard). This acronym is intended as an insult to homeowners and neighbors. You are also an “activist” if you live in a home or neighborhood.

The 85 West Portal project will be a monument to Wiener’s bad planning legislation—the first of many. Please think carefully before you vote for Scott Wiener in California’s 11th Congressional District race for the House of Representatives.

George Wooding, Neighborhood Activist Emeritus

March 2026